Credit Spread Volatility | Using Implied Volatility & Delta

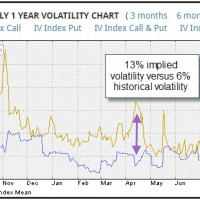

Credit spread volatility is critical to the selection and management of income-producing market positions. Whether using Implied Volatility (IV) or Delta, or both, the investor must consider option volatility, along with other data-driven trade selection criteria, to produce the highest reward/risk ratio trades.

Read more