Weekly Recap and Outlook on Markets and Credit Spreads Screening

Summaries of Important Headlines in the Week

Unsustainable Heating Consumer Price Index

Market & Economic Recap A week of low range moves and closing slightly lower than the previous week. Core consumer price index (CPI) jumps to 5.4%, the biggest gain in 13...

Read More "Unsustainable Heating Consumer Price Index"

Benefit Credit Spreads Trading from Hiking Volatility in the Third Quarter of 2021

Market & Economic Recap A roller coaster week. All markets tumbled on Thursday, followed by Dow and S&P 500 creating new highs on Friday. While the markets have seen low...

Read More "Benefit Credit Spreads Trading from Hiking Volatility in the Third Quarter of 2021"

Warmer United States and Cooler China

Market & Economic Recap June nonfarm payroll came in hot, confirming that the U.S. economy is gradually returning back to normal. National home price index for April was up 14.6%,...

Read More "Warmer United States and Cooler China"

High Tech at the Spotlight

Market & Economic Recap NASDAQ hit new high, implying that high tech is at the spotlight again. Amazon’s Prime Day took place this week. It is worth monitoring Prime Day effects...

Read More "High Tech at the Spotlight"

Fed Turns to Hawkish

Market & Economic Recap There was no surprise that Federal Reserve was the key player in this week’s markets. Fed is keeping interest rates unchanged at 0%-0.25% and continuing bond...

Read More "Fed Turns to Hawkish"

Overnight RRP Reaches New High

CPI of the U.S. climbs up 2.7% during the first 5 months of this year. At this rate, CPI measured inflation will rise 6.5% in 2021. However, whether this rate...

Read More "Overnight RRP Reaches New High"

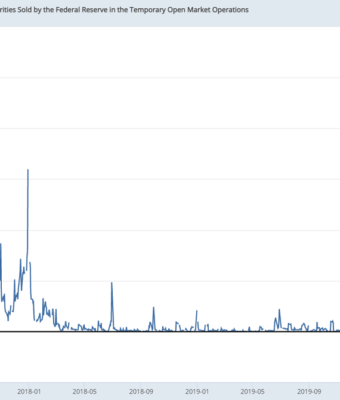

Bad Non-Farm Payroll and Corporate Bond Divestment by Fed

Non-Farm Payroll reported this week shows the U.S. economy missed the estimate of 650,000 non-farm jobs but with 559,000 even as the unemployment rate cratered to a new pandemic-era low. The...

Read More "Bad Non-Farm Payroll and Corporate Bond Divestment by Fed"

Money Supply is Surging

S&P Case Shiller Index surged up 13.2% in March, the fastest price gains since the housing bubble top in 2005. For example, Phoenix was up a ballistic 20.0%, San Diego...

Read More "Money Supply is Surging"